Medicare Part D isn’t just a drug benefit-it’s a massive economic engine built around one simple idea: generics save money. Since its launch in 2006, the program has filled over 10 billion prescriptions, and nearly 9 out of every 10 of those were for generic drugs. That’s not an accident. It’s the design. The entire structure of Part D is built to push beneficiaries toward cheaper, equally effective generic medications-and it works. But how exactly does it work? And why do some people still end up paying too much-even when generics are available?

How Tiered Formularies Drive Generic Use

Every Medicare Part D plan uses a tiered formulary, which is just a fancy way of saying they organize drugs into price levels. Think of it like a grocery store: the cheapest items are at the front, the most expensive are in the back. In Part D, Tier 1 is where you find preferred generics. These are the drugs that cost the least-often $0 to $10 for a 30-day supply at a preferred pharmacy. Tier 2 holds regular generics, usually around $15. Tier 3 is where brand-name drugs start showing up, often $45 or more. And if you need a specialty drug? That’s Tier 4 or 5, where prices can hit $100+. The system is simple: lower copay = more likely to be picked. In 2023, 87.3% of all Part D prescriptions were for generics. That’s up from just 54.6% in 2006. Why? Because the financial incentive is clear. If your blood pressure med is $0 on Tier 1 but $45 on Tier 3, you’re going to choose the $0 option. And the plan? It saves money too. Generic drugs cost Part D plans an average of $18.75 per prescription. Brand-name drugs? $156.42. That’s an 88% cost difference.The Hidden Math Behind Savings

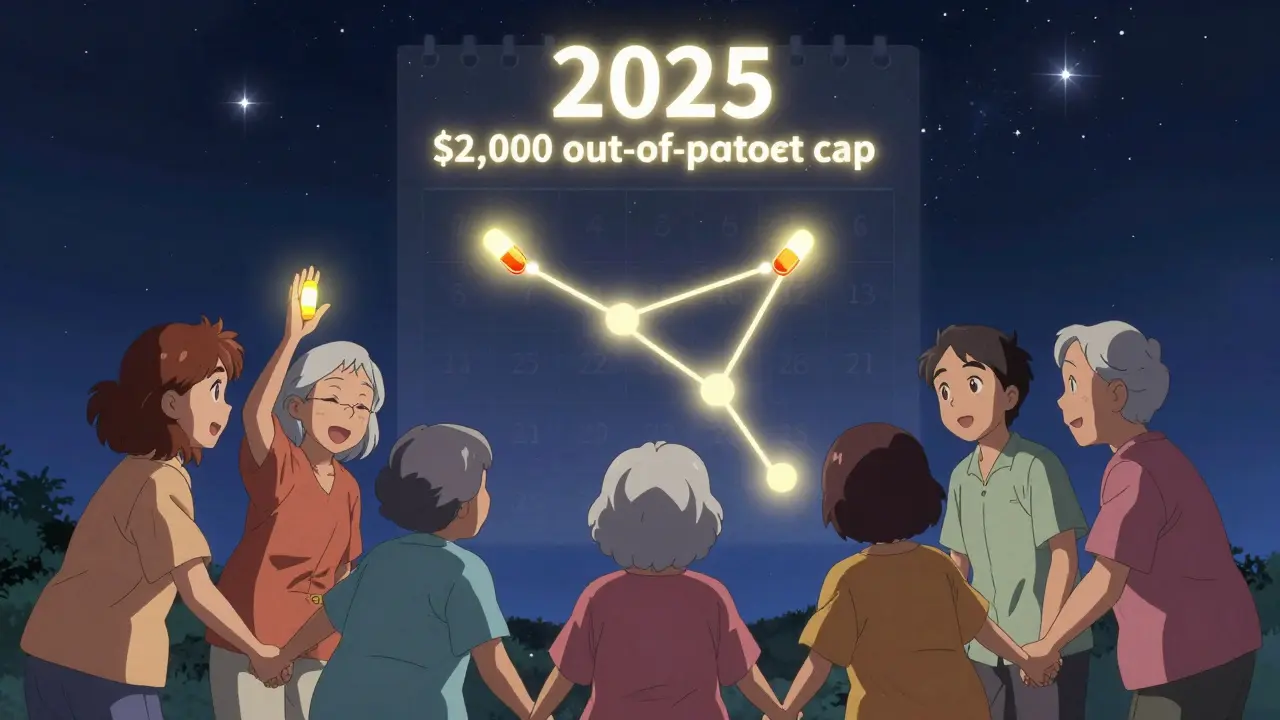

Let’s say you take one generic medication that costs $10 a month. That’s $120 a year. If you took the brand-name version instead-say, $75 a month-that’s $900 a year. Just for one drug. Multiply that across millions of beneficiaries, and you’re talking billions in savings. The numbers back it up. In 2023, Medicare Part D spent $198.4 billion total on prescriptions. Generics made up only 24.1% of that spending-even though they accounted for 87.3% of prescriptions. That’s the power of generics. They’re the workhorses of the system. Brand-name drugs, which make up just 12.7% of prescriptions, are responsible for 75.9% of the total cost. The Inflation Reduction Act of 2022 added even more pressure on this system. Starting in 2025, beneficiaries won’t pay more than $2,000 out of pocket for drugs in a year. That sounds great, right? But here’s the twist: the cap kicks in after you’ve spent that much. So if you’re taking a high-cost brand-name drug, you might hit the cap faster. But if you’re on a generic, you’re less likely to hit it at all. That means the program saves even more when people stick with generics.What Happens in the ‘Donut Hole’?

The coverage gap-also called the donut hole-used to be a nightmare. Back in 2019, beneficiaries paid 70% of the cost for brand-name drugs and 44% for generics during this phase. That meant people skipped doses, delayed refills, or went without meds entirely. That changed with the Bipartisan Budget Act of 2018. Now, everyone pays 25% of the negotiated price for both brand-name and generic drugs during the coverage gap. That’s a huge win. But here’s the catch: the 25% is based on the plan’s negotiated price, not the list price. And for generics, that negotiated price is often way lower. So even though the percentage is the same, the actual dollar amount you pay for a generic is usually $5 or less. For a brand-name? It could be $50 or more. In the catastrophic phase, the difference is even clearer. You pay the greater of 5% coinsurance or a flat copay: $4.15 for generics, $10.35 for brand-names. So if your generic costs $20, you pay $4.15. If your brand-name costs $200, you pay $10.35. The math still favors generics-even when you’re in the most expensive phase.

Why Some Generics Still Cost Too Much

Not all generics are created equal. That’s the problem. Some plans put certain generics-especially specialty ones like those for autoimmune diseases or mental health-into higher tiers. Why? Because the manufacturer doesn’t offer a big enough discount to the plan. So even though the drug is chemically identical to the brand, you pay more. A 2023 CMS report found that 63.2% of beneficiaries would pay more if they switched plans without checking the formulary. That’s a trap. You think you’re on a good plan because your blood pressure med is $0. Then next year, it moves to Tier 2. Now it’s $15. No warning. No notice. Another issue: therapeutic interchange. Pharmacists can automatically switch your brand-name drug to a generic-unless your doctor writes “dispense as written.” But 58.6% of generic fills happen this way. What if the generic causes side effects? You might not know until you feel worse. And if you’re on a protected class drug-like an antidepressant or immunosuppressant-you’re supposed to get all or nearly all options. But even then, plans can still limit access through prior authorization.Who Benefits the Most?

Low-income beneficiaries get the biggest help. If you qualify for Extra Help (a federal program for people with limited income), you pay no more than $4.15 for generics and $10.35 for brand-names. No deductible. No coverage gap. Just low, predictable costs. But even for those who don’t qualify, the savings are real. A 2023 Kaiser Family Foundation analysis found that beneficiaries using Tier 1 generics saved between $1,560 and $2,340 per year compared to using brand-name drugs. That’s more than the average Social Security increase in 2024. And it’s not just about dollars. People who use generics are more likely to stick with their meds. A 2023 CAHPS survey showed 78.4% of beneficiaries were satisfied with their plan’s generic coverage. But here’s the dark side: 32.1% of low-income beneficiaries still skip doses because of cost-even when generics are available. That’s a system failure. The economics work. But the human cost? Still too high.

What You Can Do to Save More

You don’t have to guess. There are tools. The Medicare Plan Finder on Medicare.gov lets you compare plans side by side. Enter your drugs, your pharmacy, and it shows you exactly what you’ll pay. People who use it save an average of $427 a year. Here’s how to use it:- Go to Medicare.gov/plan-compare

- Enter your medications, including dosage and frequency

- Filter for plans with $0 copays on Tier 1 generics at your preferred pharmacy

- Check if your drugs are on formulary and what tier they’re in

- Look for plans that don’t require prior authorization for your generics

Ryan Pagan

January 29, 2026 AT 01:19Generics are the unsung heroes of Medicare Part D. I used to think brand-name was better until my dad switched from Lipitor to atorvastatin and saved $200 a month. Same pill, same results. The system works if you know how to play it. Check your formulary every year like it’s a Black Friday sale-because it is.

Paul Adler

January 29, 2026 AT 05:04While the economic rationale for generic drug utilization is sound, one must also consider the psychological and behavioral dimensions of patient adherence. The perception of inferiority associated with generic medications, though medically unfounded, remains a persistent barrier in certain demographics. A nuanced approach that combines cost incentives with patient education may yield more sustainable outcomes.

ryan Sifontes

January 30, 2026 AT 13:17theyre lying about the savings. the big pharma companies own the generic makers too. its all a scam to make you think youre getting a deal. they just repackaged the same crap in a cheaper bottle. dont trust the gov. or the plans. theyre all in on it.

Megan Brooks

February 1, 2026 AT 02:35There's a quiet dignity in the way generics quietly sustain millions of lives without fanfare. They don't need advertising or celebrity endorsements. They just work. And yet, we treat them like second-class citizens in the pharmacy aisle. Maybe the real failure isn't the system-it's our unwillingness to value effectiveness over branding.

Frank Declemij

February 1, 2026 AT 04:4787.3% of prescriptions are generics but only 24.1% of spending. That math is undeniable. If you're paying more than $10 for a Tier 1 generic, you're either on the wrong plan or not using the Plan Finder. It takes 10 minutes. Do it.

Kacey Yates

February 2, 2026 AT 10:51Stop acting like this is some genius policy. It’s just corporate greed dressed up as savings. They push generics so hard because they make more profit off the ones they control. And when your antidepressant gets switched without warning? That’s not efficiency-that’s medical roulette. I’ve seen people crash because of this.

Laura Arnal

February 3, 2026 AT 19:48Just switched my mom to a $0 generic plan last year and she’s been smiling ever since 😊 Seriously, if you’re on Medicare, go to Medicare.gov right now and check your plan. It’s the easiest $500 you’ll ever save. Thank me later!

Jasneet Minhas

February 4, 2026 AT 16:02India exports 40% of the world’s generics. We make them cheaper than you can imagine. Funny how Americans think generics are ‘cheap’ when they’re literally made in our factories with the same FDA standards. The real scandal? You’re paying more because your system doesn’t negotiate hard enough.

Eli In

February 4, 2026 AT 17:06My grandma takes six generics a day. She says, ‘If it keeps me walking, I don’t care what it’s called.’ That’s the real win here. Not the dollars. Not the stats. It’s people like her getting to live their lives without choosing between pills and groceries.